In Part I of this topic, we addressed the new Fannie Mae guidelines that focus on condominium safety and infrastructure. The guidelines are directly tied to association reserves and the prevalence of underfunding among condo associations. HOAs and condo boards often look to special assessments and loans to address pressing capital expenses. RISE Association Management Groups urges – PROCEED WITH CAUTION!

Condo reserves and underfunding

Condominium associations often face the challenge of underfunding, especially for maintenance projects and long-term infrastructure needs. While regular maintenance fees are meant to cover most of these expenses, unforeseen circumstances or cost underestimation can lead to budget shortfalls. Condo associations are often unclear about how much money is needed in reserves partially because the purpose of reserves is often mistaken for a “rainy day fund” when it is in fact more like an earmarked special purpose savings account. In fact, there is a specific way to calculate exactly how much money your condo needs in reserves: get a reserve study. The total balance in your reserve fund should directly correspond to the assets it is intended to be used for.

However reserve funds are seldom 100% funded. This issue is so pervasive that In Florida a new condos reserves law passed in 2022 and will become effective in 2025 mandating certain reserve contributions. Texas, however, has no such requirements. In fact, for Texas homeowners associations determining how much you need in reserves is often done by reverting to the old rule of thumb of contribution 10% of operating assessments each year. However, this rule is outdated and does not anticipate the complexity of common condominium infrastructure needs. The changes in Florida, which other states often mirror, will require buildings three stories or higher to set aside funding for major safety and infrastructure items like concrete restoration, roof reinforcement, and plumbing replacement. Condo boards and HOAs across the country are closely watching the impacts of this law.

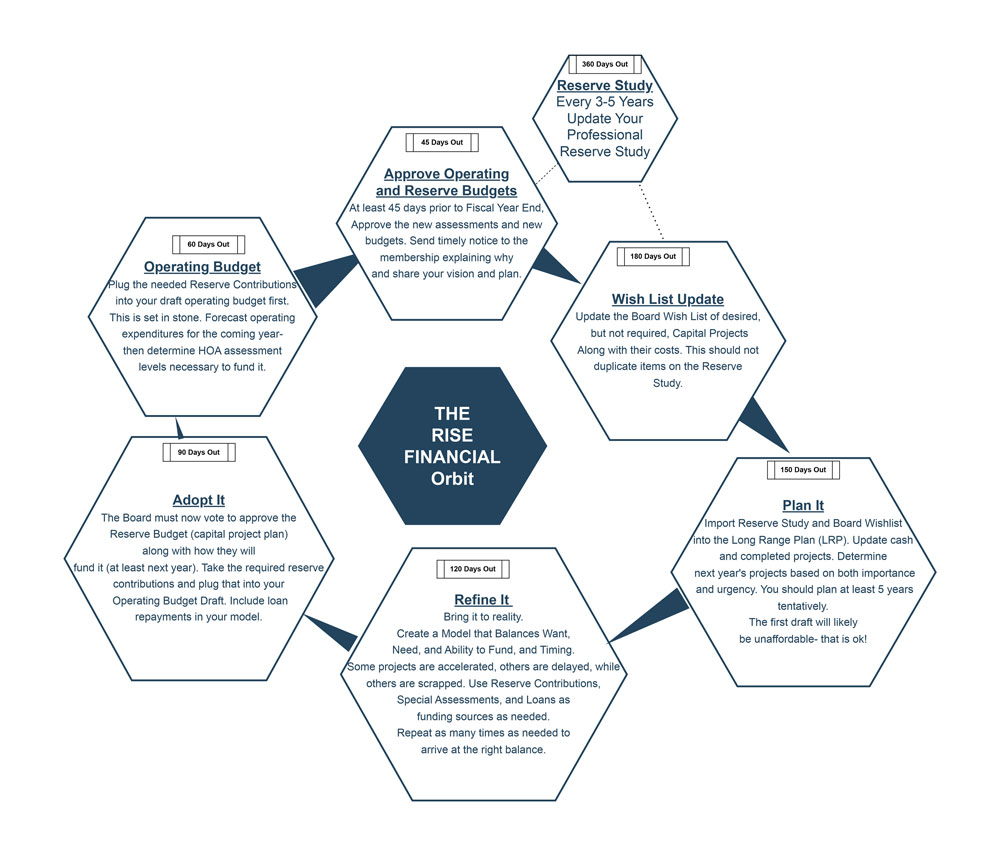

Reserve studies and long-range planning can help answer the question “How much money should our condo association have in reserves?” When a budget shortfall occurs, special assessments and loans are two common ways to bridge the gap. However, both methods come with their unique advantages and disadvantages.

Special Assessments

Special assessments are additional charges levied on condominium owners to cover specific expenses that exceed the budget. These can be planned or emergency in nature.

Pros:

- 1. Immediate Funding: Special assessments provide immediate funds for pressing needs, avoiding delays in critical maintenance or infrastructure projects.

- 2. No Interest Payment: Unlike loans, special assessments do not involve interest payments, keeping the overall cost lower.

- 3. Direct Connection to Specific Needs: Funds are earmarked for a particular project, ensuring transparency and accountability.

Cons:

- 1. Unpredictable Costs for Owners: Special assessments pose an unexpected burden on owners, particularly if they are levied suddenly.

- 2. Potential for Conflict: The decision to impose a special assessment may lead to disputes among owners, especially if there is disagreement about the necessity or scope of the project. Often special assessments require approval of the membership, which can lead to very public debate about why the condo association board of directors or the condo association management company did not anticipate the expense.

- 3. Impact on Property Values: Frequent or high special assessments might deter potential buyers, negatively affecting property values. Once a building develops a reputation as underfunded and subject to surprise assessments, word spreads and the real estate market responds quickly.

- 4. Potential Impact on Home Loans: Special Assessments often send a message of “underfunding” or “possible emergency repairs for deferred maintenance” which are red flags for home loan underwriters, including loans conforming for Fannie Mae or Freddie Mac guidelines. This tends to result in scrutiny and can make it more difficult to obtain a home loan.

Loans

Another funding option, loans, allows a condominium association to borrow funds to cover the shortfall and pay it back over time.

Pros:

- 1. Spreading the Cost Over Time: Loans allow the cost to be spread over several years, making it easier for owners to manage financially.

- 2. Maintaining Cash Flow: By taking a loan, the association can maintain its cash flow and continue other essential operations without disruption.

- 3. Avoiding Immediate Financial Burden: Owners are not immediately burdened with a large payment, as with special assessments.

Cons:

- 1. Interest Payments: Loans come with interest, which adds to the total cost of the project.

- 2. Long-Term Financial Commitment: Repaying a loan requires a long-term financial commitment, which might not align with the HOA or condo board association future financial plans.

- 3. Potential Impact on Home Loans: Like special assessments, a loan can trigger red flags for home loan underwriters, including loans conforming for Fannie Mae or Freddie Mac guidelines. This might result in scrutiny or failure to be approved, which will impact the available pool of buyers.

RISE recommends: A Balanced Approach to Association Reserves

The decision to utilize special assessments or loans to address underfunding in a condominium association is complex and context-dependent. While ideally, you would fund your reserves as you go and never find yourself in a shortfall, the reality is that we must be familiar with and explore practical alternatives when that is not the case. Special assessments provide a direct and interest-free solution, they can cause immediate financial strain and discord among owners. Loans offer a way to spread costs over time but come with interest and long-term commitments.

A balanced approach, incorporating careful planning, transparent communication, and professional financial guidance, can mitigate the drawbacks of both methods. Regular reserve studies and long-range funding plans should be integral to this process, enabling associations to anticipate needs and choose the most appropriate funding strategy.

Ultimately, whether special assessments or loans are the right solution depends on the specific situation and needs of the condominium association. Open dialogue, clear understanding of the pros and cons, and expert consultation can pave the way for sound financial decisions that serve the best interests of the condominium community.

RISE has the experience and expertise condo associations rely on for reserve planning and on-going management. As the saying goes, people don’t plan to fail, they fail to plan. We’re ready to keep your community ahead of the budgeting curve and prepared when issues arise. Connect at [email protected].