Let’s start by reviewing exactly what a condo reserve fund is. The condo reserve fund covers capital expenditures that will occur due to repair or replacement of critical items as they wear out. Your management company or condominium association should have a condo reserve fund study on hand and that study needs to be updated yearly to define what those systems are and the anticipated date of failure with replacement cost. Remember, the elements, heat and humidity, in the Houston area take their toll on these critical systems.

Are there condo reserve fund standards for financing?

Rule of thumb says there should be at least 10% of your annual operating budget in your condo reserve fund at any time. In fact, for FHA insured loans, Fannie Mae or Freddie Mac loans, it is actually a requirement that an amount equal to 10% of your annual operating budget be set aside in your condo reserve fund. Additionally, Freddie Mac and Fannie Mae require that no more than 15% of the homeowners be delinquent on their assessments. Click here for more info.

What is the benefit to you?

A condo reserve fund that is equal to 10% of the annual operating budget on deposit helps to ensure that you as a condo owner will not be hit with last minute assessments to address critical failures. So, it should be limited surprises when it comes to maintenance assessments and repairs. This also helps you when it comes to personal budgeting. When you decide to sell your unit, it will also act as a selling point allowing for more financing options and better comfort for the buyer that this is a fiscally responsible property.

Things that can have an effect on your condo reserve fund

There are many things that can affect your condo reserve fund. Inflation is one of them. You may think that the interest you are earning on the deposited reserve fund money will offset this, but consider this: it takes a 13% increase in reserve contribution to offset a 1% increase in inflation.

The age of your complex also has a direct effect on the amount you need in your condo reserve fund. The newer the units, the less needed in reserves, as things are at their beginning of life. However, as a complex ages, you could need as much as 30% more to accommodate the aging items that are covered by your reserve fund.

Your objective in funding also is a factor; if you plan to be 100% funded obviously your monthly amount will be more. If you are using baseline funding, be ready for additional assessments.

What’s the golden number?

For most condominium projects across the country and in the Houston area, the golden number for condo reserve fund assessment is anywhere between $50 and $100 per month. While this might sound like a substantial number, consider this, an assessment of $1500 hitting at the wrong time can be devastating.

Get with your management company and/or condo board today and find out first if they have done a condo reserve fund study and second, if they are meeting the minimum requirements of 10% of the yearly operating budget being assessed for the condo reserve fund. Don’t get caught off guard!

What your condo board needs to know

Condominiums are an integral part of the urban housing landscape. They offer equity-building opportunities, extensive community amenities, and iconic architectural styles. Condo ownership is on the rise in places like Houston and across Texas. This makes the topic of association reserves especially timely. In this two-part blog post, RISE Association Management Group covers condo association reserve fund guidelines all board members must know.

Condo reserves

The tragic collapse of Champlain Towers in Surfside, Florida highlighted an existential threat looming over condominiums of all ages: underfunded infrastructure. Resident safety must always be at the forefront. This issue raises a vital question for condo boards, managers, owners, and prospective buyers – how much should a condo association have in reserve funds to adequately address infrastructure needs?

Association funds and underfunding

Underfunding is pervasive among condos, regardless of their age. A lack of understanding about longrange infrastructure needs often leads to underfunding. The two main reasons include:

- Insufficient Visibility: Buildings require regular maintenance; not all needs are clearly apparent. Without a long-range plan or reserve study, boards may believe they have sufficient funding, leading to a shortfall.

- Insufficient Reserves: Every building and every community is different. Since there is no one-sizefits-all formula, insufficient reserves can deter buyers, creating a situation where funding is continually inadequate.

New condo reserves law

The Federal National Mortgage Association, commonly known as Fannie Mae, implemented new guidelines, effective August 2023. The guidelines require appraisers to focus more on safety and infrastructure. RISE wrote about this in detail. Highlights of the new Fannie Mae project review requirements include examining significant deferred maintenance, as well special assessments and condominium loans. This could result in severely limiting financing options for buyers, and create an onerous underwriting process for lenders and appraisers.

Condominiums governance

Condominiums operate more like small cities, with a board making financial decisions that impact ongoing maintenance, budgets, and special projects. Condo boards must balance short-term interests with long-term funding plans. This can be challenging in the face of conflicting perspectives and visions. Working with HOA management companies like RISE can reduce or eliminate individual interests that may overshadow the collective goals of the board.

Another solution may lie in legislative action, requiring reserve studies and balanced long-range funding plans to be disclosed as part of any real estate transaction. This will allow buyers, lenders, and the market to properly assess the value of a sufficiently funded reserve.

The optimal reserve amount

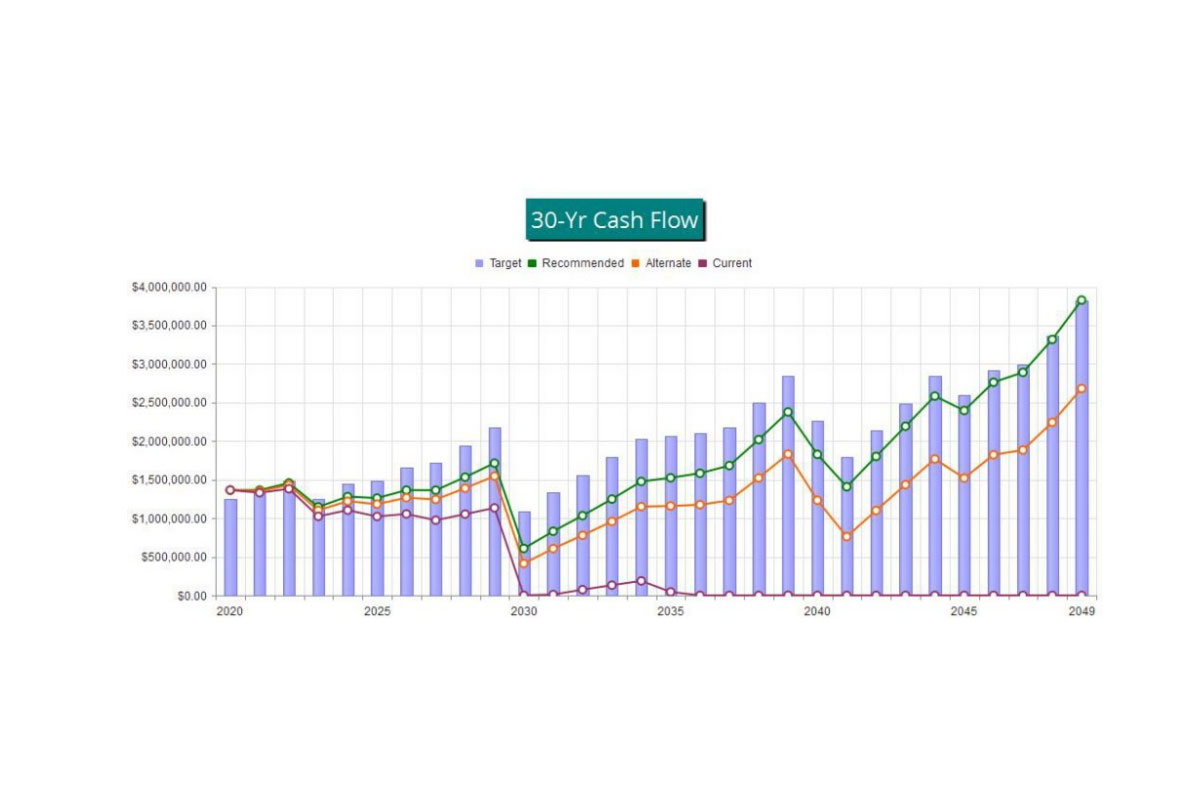

Determining the exact reserve amount is complex and must be tailored to each condo’s specific needs. However, the condo reserves rule of thumb should involve:

- Obtaining a Reserve Study: Working with a firm experienced in developing condo reserve studies will provide insights into long-range infrastructure funding needs.

- Creating a Long-Range Funding Plan: The condo board should review this plan annually and use it as a guide for budgeting.

- Consulting with Professionals: Engaging experts in reserve planning and long-range funding can aid in determining the right reserve levels tailored to each condominium’s needs.

By taking these steps, condominium associations can better prepare for major infrastructure investments, ensuring they do not face financial reckoning down the line. The time to act is now, especially with the looming impact of new lender guidelines, to ensure that condominiums continue to serve as beautiful and functional housing solutions for all.

Be sure to stay tuned for Part II of our Association Reserves topic – condo special assessments and loans.

Want to learn more about a condo reserve study? The professionals at RISE are here to make your job easier. Contact us at [email protected].