This article is a field manual and HOA Board Member training on the basics of your property insurance coverage with an emphasis on claims, limits, and responsibilities relating to windstorm damage. This pre-hurricane season review will help prepare your HOA’s Board before the next big storm hits. We’ll cover some of the most likely useful terms and questions you may encounter as an HOA/COA leader. In all scenarios relating to hurricane we make the assumption that you may be without phone, power, or internet some period of time so we encourage you to print the materials described herein and keep in a safe place.

What You’ll Need

First, ensure you have a copy of your HOA/COA’s certificate of property insurance. We recommend Acord 28 Evidence of Insurance as this contains more detail regarding the property coverages, sub limits, coverage forms, and deductibles. If this isn’t available, the Certificate of Property Insurance Acord 24 can answer some of these questions, but you will have to consult your policy for other aspects.

Next, download your supplies checklist here.

Step 1: Identify Your Coverage Form

Coverage forms determine what “causes of loss” are covered as well as what common exclusions apply to coverage. The Special Causes of Loss form is the most common for homeowners associations and condominium associations and is generally the broadest, as it is written to include all losses unless they’re specifically excluded. However, Basic and Broad are still in use in certain situations. Note, NONE of these cover flood or earthquake so unless you have a special endorsement adding it (rare) or a separate stand alone flood policy then you do not have flood coverage. This means if you experience damage from rising water from an area not normally covered by water then you’ll need to read part two of this field manual.

Basic Form

The Basic Causes of Loss form provides coverage against a limited list of specifically named perils such as fire, lightning, explosion, smoke, windstorm, hail, vandalism, and certain types of water damage. This form offers the most limited protection and is generally less expensive. However, if a loss occurs and it’s not specifically named in the policy, there will be no coverage. These are not commonly used for HOAs but it is best to check as this is a very strict coverage form and may well also come with Actual Cash Value payouts only versus Replacement Cost Values.

Broad Form

The Broad Causes of Loss form includes all the perils in the Basic form and expands coverage to include additional risks such as falling objects, weight of snow, ice or sleet, and water damage associated with plumbing issues. This form is more comprehensive than the Basic form and is suitable for those seeking a middle ground in terms of coverage and cost.

Special Causes of Loss Form (Special Form)

The Special Causes of Loss form provides the most comprehensive coverage. It is an all-risk policy, covering all perils except those explicitly excluded in the policy documents. Common exclusions include earthquakes, floods, government action, nuclear hazard, and normal wear and tear, among others. This form is preferred for providing the broadest protection, and it shifts the burden to the insurer to prove that an exclusion applies before denying a claim.

Open Perils

“Open Perils” is another term often used interchangeably with the Special Causes of Loss form. It signifies that the policy covers all forms of loss that are not specifically excluded. This is in contrast to “Named Perils” coverage, which only covers perils that are specifically mentioned in the policy.

Step 2: Identify The Limit of Coverage

The simplest question to answer is, “How much coverage do I have?” but it is key to know that this is different from “How much will my property insurance company pay for a total loss?” Total Insured Value is used to describe the value of the property insured (e.g. the buildings, plus the contents, plus the structures and outdoor property) but the total limit of coverage may be less than the total value of the property insured. These are known as sub limits or loss limits. If sub limits and loss limits apply, then they will vary depending on the type of loss or type of property. For example, it is very common to have coverage for trees and shrubs but for it to be capped at a set figure such as $5000 even if you have much more than $5000 in trees and shrubs scheduled in the policy.

The coverage limit you’re looking for in preparation for hurricane season is the limit coverage associated with a Named Storm or All Other Wind peril (we still get El Derecho like storms during hurricane season). Windstorms in recent years have been especially subject to sub limits and loss limits, as insurance carriers have increasingly sought to place a limit on their liability for along the Gulf Coast. If you have a “loss limit,” then that quite literally means that the insurance company will not pay more than that for a loss of that sort and if your costs exceed that limit you will be out of pocket. The loss limit is calculated after the deductible so that your deductible will not erode your coverage limit.

This will be identified under the Windstorm section and Named Storm of your Acord 28. If you do not have the Acord 28, check the declarations page of your property insurance policy. Note, your windstorm policy may be a separate policy from your All Other Perils (sometimes called the Fire policy). Also, be sure you have a Business Income/Extra Expense limit that is sufficient to cover others costs you may incur such as extra security, fire watch, or costs that you incur indirectly to reduce the amount of time your property is uninhabitable.

What Property is Covered?

For an HOA, covered property should include all common areas, including structures located thereon, contents owned by or in the custody of the HOA, and any outdoor property (including furniture, fencing, trees, and shrubs). Sorry to disappoint those of you who just lost some trees in the last Derecho, but trees and shrubs usually carry a sublimit of coverage. If you lost some earlier this year in the deep freeze, unfortunately, “freeze” is typically excluded as a cause of loss.

For condominiums, it should include all of the above plus any “Common Elements” as defined under the Condominium declaration. Many condominiums also have a requirement that the Association insure the Units to at least the original cost of construction. Condominiums with stacked units are required by Texas Property Code 82.111 to carry coverage for Units but need not include coverage for betterments/improvements. The total insured value on your policy should add up to the total of the scheduled values of all these items. This will often be noted on the Additional Remarks Schedule.

Important note: when applying for insurance, you should schedule this property out specifically and the value of each, otherwise you may not have coverage for it. Ask your agent for the schedule of covered property if you want to verify.

What is the basis on which the insurance company will compensate me for the loss?

Replacement Cost Value (RCV) and Actual Cash Value (ACV) are two common methods used to determine the value of insured property at the time of loss. Replacement Cost Value covers the cost of replacing the damaged property with new property of similar kind and quality without any deduction for depreciation. This method ensures that the policyholder can restore or replace their property to its original condition prior to the loss. In contrast, Actual Cash Value takes depreciation into account, paying the policyholder only the current value of the property at the time of the loss. This amount is calculated by determining the replacement cost of the item and then subtracting depreciation, which considers factors like age, wear and tear, and obsolescence. Your Acord 28 will indicate whether the policy is written as ACV or RCV (see example) however you likely still have certain components that will be valued as ACV.

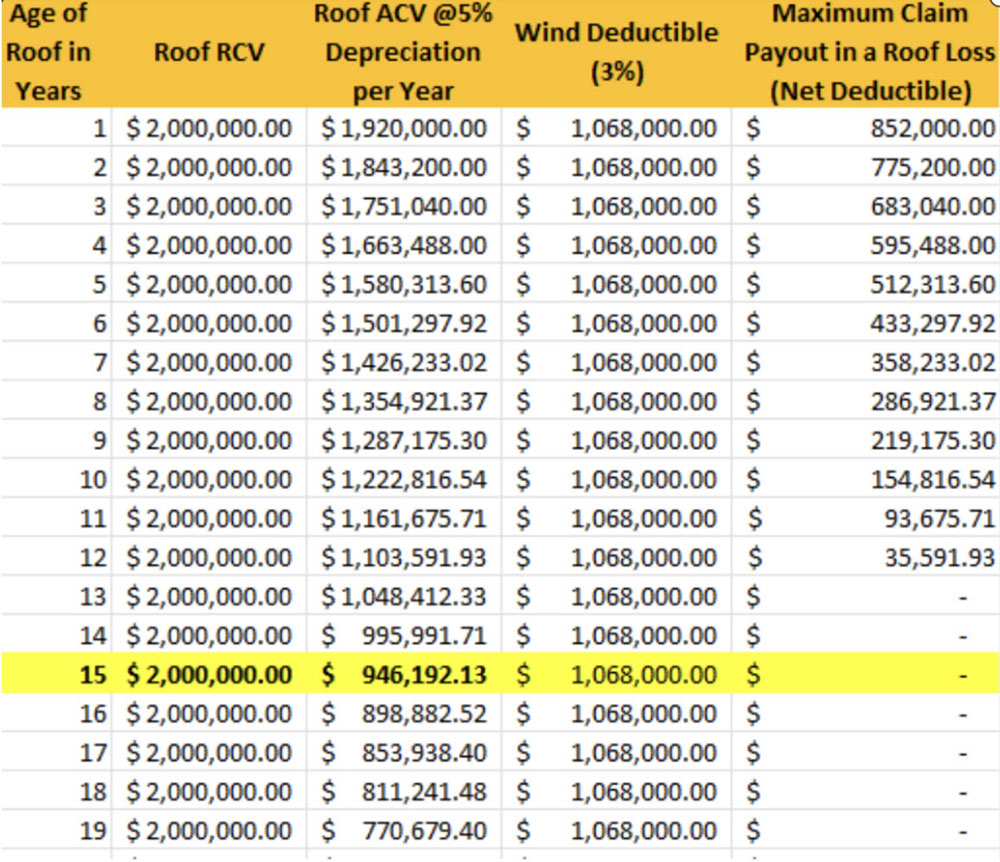

In the realm of property insurance, there are several common items that are often valued on an ACV basis due to their susceptibility to depreciation over time. Roofs over 12 years old are among the most common to be valued on an ACV basis. The table below shows a claims scenario for an older roof at a property with a 3% Wind Storm Deductible.

What is the deductible before coverage applies?

Named Storms, which refer to tropical events including hurricanes, tropical depressions, and tropical storms, are a unique risk exposure to the Gulf Coast. As they carry a uniquely high risk of widespread damage, the deductible for a loss from a Named Storm (the amount you are responsible to pay before insurance coverage applies) is often much higher than other types of losses such as a fire. Named storm deductibles and sometimes Nonnamed Wind Storms (All other Windstorms) deductibles are expressed as a percentage of the property’s total value or as a percentage of a building’s total value. For example, if you have 10 buildings valued at $1,000,000 each and a 5% Named Storm Deductible, your total deductible would be $500,000. If it is 5% per building, then each building has its own deductible which is calculated as 5% x $1,000,000 = $50,000. If stated as a flat amount, then check if it is per occurrence or per building.

Is There a Coinsurance Penalty?

While it is only applicable if the property is “undervalued” at the time of the loss, this is an important number. If you have a policy with a coinsurance penalty, that in itself is not a problem unless you are carrying too little property insurance coverage for the property that is being covered.

Coinsurance is calculated using the formula: (Amount of Insurance Carried ÷ Amount of Insurance Required) × Loss Amount, which determines the portion of the claim that the insurer will pay based on whether the property was insured to the required percentage of its value.

What is Special Assessment Coverage or Loss Assessment Coverage?

Loss assessment coverage is a critical feature for individual homeowners in a homeowners association (HOA). This is NOT for any run-of-the-mill special assessment. This type of coverage is specifically for when a covered loss affects commonly owned property within the community, or there are liability claims against the HOA that exceed the association’s policy limits. For instance, if a storm damages a shared facility like a clubhouse or community pool and the Association passes a Special Assessment to pay for the deductible for the HOA’s insurance policy. It could also be if there is a lawsuit against the HOA for an injury occurring in a common area, the costs for repairs or legal fees may be divided among the homeowners. Loss assessment coverage helps individual homeowners cover their portion of these costs, up to the limits of their policy. Without this coverage, homeowners would have to pay out of pocket for their share of these unexpected and potentially large expenses, which could be financially burdensome. However the type of loss resulting in a Loss Assessment must be a coverage cause of loss under your individual policy- so this likely will not cover flood unless you have individual flood coverage.

In the Event of a Loss

In the event of a loss, it is crucial to act promptly to mitigate damage and preserve property, as delaying can lead to greater losses and complications with claims. Policyholders have a clear responsibility to save and preserve property immediately following a loss; waiting for an insurance adjuster to arrive on the scene may worsen the situation. It is advisable to engage a qualified contractor who is experienced in dealing with insurance claims and familiar with the insurance carrier’s standard estimating software, Xactimate. This contractor can effectively document the damage and provide an accurate estimate, ensuring that the restoration process aligns with the insurance policy’s expectations and standards. This proactive approach not only speeds up the recovery process but also helps in presenting a well-documented claim to the insurance company, enhancing the likelihood of a favorable settlement.

Keep Track of your Expenses, including indirect Expenses

Regarding extra expenses, costs such as fire watch and security services are typically covered under the extra expense provision of a property insurance policy, provided that there is a specified limit for such expenses in the policy. This coverage is vital for ensuring the property remains secure and further damage is minimized in the aftermath of an incident. However, business income coverage, which compensates for lost income during the period a business is unable to operate normally due to damage, generally does not apply to homeowner associations (HOAs). This is because HOAs typically do not generate business income in the traditional sense, and the financial obligations of the residents, such as dues or assessments, continue regardless of the property’s condition. Thus, while the property may be undergoing repairs, the financial mechanism of the HOA remains unaffected, negating the applicability of business income coverage but underscoring the importance of extra expense coverage in maintaining security and safety during the restoration period.

Check Your Own Personal Homeowners Policy or HO6 Policy

Things like your personal contents, additional living expenses for hotels, and loss assessment coverages are commonly overlooked. Now is the time to ensure you have sufficient coverage for these. As mentioned above in the Loss Assessment section, you should anticipate that, as a general rule, that no HOA would pay a Named Storm Deductible out of HOA reserves when they can pass a special assessment which could be covered by the homeowners’ personal insurance. Be sure you carry a sufficient limit in case this happens or if there costs in excess of your HOA’s limit of coverage. If you’re in a condominium, make sure your Coverage A is sufficient for your Unit regardless of whether your condominium master policy covers your units. You are likely going to be individually responsible for damages to your Unit that are below the deductible (which is likely very high).

Take the Assessment and Test Your Knowledge

Test your knowledge of HOA Insurance and hurricane preparedness!

More Questions?

If you have more questions feel free to reach out to our team or contact your insurance agent for a more in depth review. If you would like to speak with a licensed agent about your policy feel free to contact our partners at Archer Risk Services at [email protected].